BTC-ETH ETF

A Bitcoin-Ethereum ETF is a special type of ETF that tracks the price of Bitcoin AND Ethereum. It allows people to invest without actually owning the cryptocurrency.

• Just One Day •

Advantages

01

OUR MISSION

Transparency, liquidity, and convenience

02

Original designs

Security without the hassle of storage

03

Net

Access the crypto market with reduced risk

Strengths

Translation Services

Legal Consultation

Business Tools

Financial ETF Statements

Deposit Insurance

Emotional Support

Personal Advisor

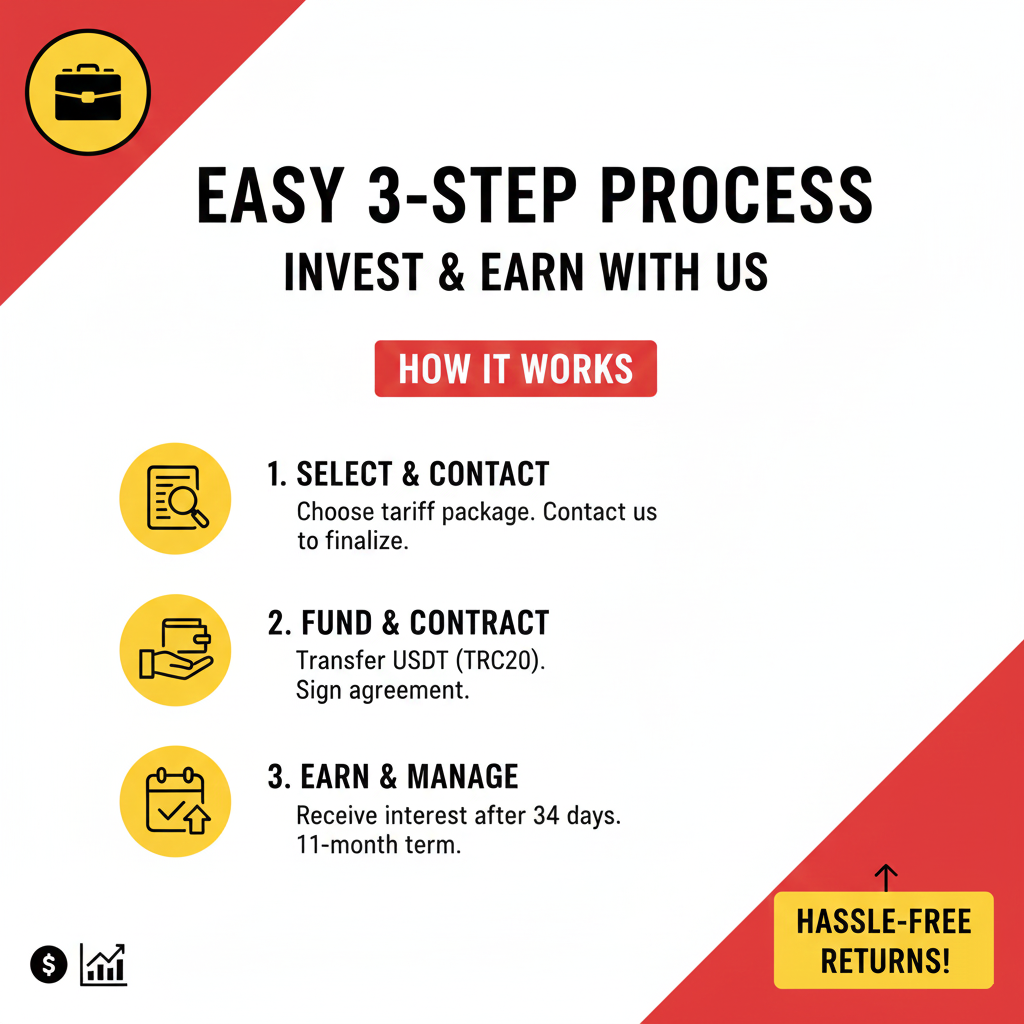

How to start cooperating with us

An Exchange-Traded Fund (ETF)

An Exchange-Traded Fund (ETF) is a pooled investment vehicle that allows investors to gain diversified exposure to various asset classes while benefiting from the liquidity and flexibility of stock market trading.

Unlike mutual funds, which are typically priced once per day, ETFs trade throughout market hours at real-time prices, just like individual stocks. This makes them an attractive option for both institutional and retail investors looking to optimise their portfolios with a cost-effective and efficient investment strategy.

ETFs can track a broad market index, a specific sector, or even alternative assets like commodities and digital currencies. They are designed to replicate the performance of an underlying benchmark, providing passive exposure to a chosen market.

How Does an ETF Work?

Diversification – ETFs typically hold multiple assets, reducing the risk associated with investing in a single stock or asset.

Liquidity – ETFs can be bought and sold throughout the trading day at market prices, unlike traditional mutual funds, which are priced only at the end of the trading day.

Lower Costs – Many ETFs have lower fees compared to actively managed funds, making them a cost-effective investment option.

Transparency – Most ETFs regularly disclose their holdings, so investors know exactly what they are investing in.

To become our client, you will need to reach out to us at the beginning of the month through one of two methods: either by sending an email to our official address or by contacting one of our specialists listed in the "About Us" section via the Telegram social network.

ETF Work? Types of ETFs

Stock ETFs – Track an index or sector, such as the FTSE 100 or S&P 500.

Bond ETFs – Invest in government or corporate bonds.

Commodity ETFs – Track the price of commodities like gold, silver, or oil.

Crypto ETFs – Provide exposure to cryptocurrencies like Bitcoin and Ethereum without requiring direct ownership.

Why Invest in an ETF?

ETFs are ideal for both beginner and experienced investors looking for diversification, flexibility, and lower costs. They offer an easy way to invest in various markets while maintaining liquidity and transparency.

Begin by selecting a suitable investment package from our range of tariff options. Next, contact us to finalise the agreement. Upon signing the contract, you will be required to transfer the designated investment amount in USDT to our TRC20 account. After a period of three months, the accrued interest will be credited directly to your TRC20 wallet.

The contract remains in effect for 11 months, and in the 12th month, you may choose to either withdraw your initial capital or renew the agreement. The process is seamless and efficient.

What about warranties and risks

Every investment carries a certain level of risk, and ETFs are no exception. No financial instrument can offer a 100% guarantee or ensure completely predictable returns. Even if you were to invest directly in a single asset like Bitcoin (BTC) or Ethereum (ETH), there is no absolute certainty that its value won’t decline significantly.

However, ETFs are designed to optimise the risk-to-reward ratio by diversifying across multiple assets, reducing exposure to extreme market fluctuations.

At our company, we base our investment strategies on thorough market analysis and historical data, projecting strong financial performance over the next 5–7 years.

While risks cannot be entirely eliminated, our approach focuses on strategic diversification and informed decision-making to create a balanced investment portfolio. The key is maximising potential returns while maintaining an acceptable level of risk, and that is the foundation of our BTC-ETH ETF.

Interaction and cooperation

POPULAR TARIFF

Returns are driven by a diversified strategy encompassing cryptocurrency pair trading, SPOT custody of digital assets, and sophisticated derivatives instruments, including futures, options, and swap contracts, all structured within the ETF framework.

MUSIC BTC-ETH etf

payment EVERY 4 MONTHS

+12%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 12%

FROM 1.000 - 3.000 USDT

DANCE BTC-ETH etf

payment EVERY 4 MONTHS

+11%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 11%

FROM 3.000 - 6.000 USDT

ART BTC-ETH etf

payment EVERY 4 MONTHS

+10%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 10%

FROM 6.000 - 10.000 USDT

FASHION BTC-ETH etf

payment EVERY 4 MONTHS

+8%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 8%

FROM 10.000 - 30.000 USDT

EUROPE BTC-ETH etf

payment EVERY 4 MONTHS

+6%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 6%

FROM 30.000 - 60.000 USDT

WORLD BTC-ETH etf

payment EVERY 4 MONTHS

+10%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 10%

FROM 60.000 - 100.000 USDT

moon BTC-ETH etf

payment EVERY 6 MONTHS

+12%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 12%

FROM 100.000 USDT

mARS BTC-ETH etf

payment EVERY 6 MONTHS

+14%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 14%

FROM 400.000 USDT

ADVANCED BTC-ETH etf

payment EVERY 6 MONTHS

+15%

• We use technology to acquire bitcoin at strategic price levels (price drawdown)

• Our approach involves acquiring bitcoins based on market price triggers

• During the current period, we will increase your deposited amount by an additional 15%